Tree Farm Tax Deductions . one of the potential tax breaks available to tree farm owners is that sales of trees are taxed at capital gains tax rates. this tax guidance helps private forest landowners and rural communities to manage their lands sustainably. If the farmer is not holding. deductible timber expenses are reported on form 1040, schedule f, if operated as a sole proprietorship. for 2018 through 2025, timber investors are not allowed to deduct eligible operating expenses through itemized deductions but. generally, all income received is taxable unless the tax law excludes, and nothing is deductible unless a provision allows it.

from materialmcgheeflusher.z21.web.core.windows.net

for 2018 through 2025, timber investors are not allowed to deduct eligible operating expenses through itemized deductions but. generally, all income received is taxable unless the tax law excludes, and nothing is deductible unless a provision allows it. deductible timber expenses are reported on form 1040, schedule f, if operated as a sole proprietorship. this tax guidance helps private forest landowners and rural communities to manage their lands sustainably. If the farmer is not holding. one of the potential tax breaks available to tree farm owners is that sales of trees are taxed at capital gains tax rates.

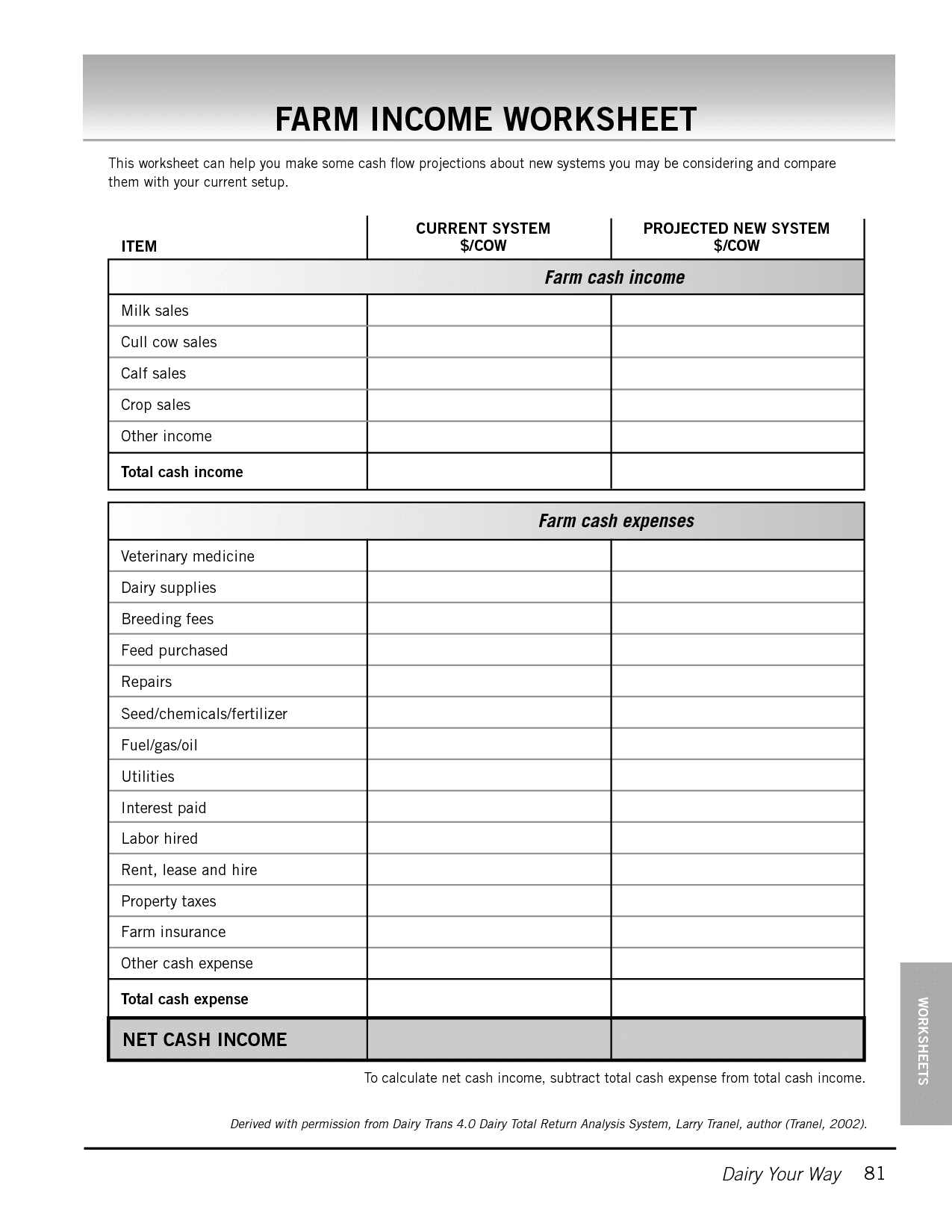

And Expense Worksheet Excel

Tree Farm Tax Deductions deductible timber expenses are reported on form 1040, schedule f, if operated as a sole proprietorship. If the farmer is not holding. for 2018 through 2025, timber investors are not allowed to deduct eligible operating expenses through itemized deductions but. one of the potential tax breaks available to tree farm owners is that sales of trees are taxed at capital gains tax rates. this tax guidance helps private forest landowners and rural communities to manage their lands sustainably. deductible timber expenses are reported on form 1040, schedule f, if operated as a sole proprietorship. generally, all income received is taxable unless the tax law excludes, and nothing is deductible unless a provision allows it.

From www.printabletemplate.us

Printable Itemized Deductions Worksheet Tree Farm Tax Deductions one of the potential tax breaks available to tree farm owners is that sales of trees are taxed at capital gains tax rates. If the farmer is not holding. for 2018 through 2025, timber investors are not allowed to deduct eligible operating expenses through itemized deductions but. deductible timber expenses are reported on form 1040, schedule f,. Tree Farm Tax Deductions.

From farmhose.blogspot.com

Tree Farm Tax Deductions Farm House Tree Farm Tax Deductions one of the potential tax breaks available to tree farm owners is that sales of trees are taxed at capital gains tax rates. deductible timber expenses are reported on form 1040, schedule f, if operated as a sole proprietorship. this tax guidance helps private forest landowners and rural communities to manage their lands sustainably. If the farmer. Tree Farm Tax Deductions.

From fightingarthritis.org.au

Come see us at the Adelaide Farmers Market! THRF Group Arthritis Tree Farm Tax Deductions deductible timber expenses are reported on form 1040, schedule f, if operated as a sole proprietorship. this tax guidance helps private forest landowners and rural communities to manage their lands sustainably. one of the potential tax breaks available to tree farm owners is that sales of trees are taxed at capital gains tax rates. generally, all. Tree Farm Tax Deductions.

From www.youtube.com

Keep Your Money Farm Tax Deductions YouTube Tree Farm Tax Deductions this tax guidance helps private forest landowners and rural communities to manage their lands sustainably. If the farmer is not holding. one of the potential tax breaks available to tree farm owners is that sales of trees are taxed at capital gains tax rates. for 2018 through 2025, timber investors are not allowed to deduct eligible operating. Tree Farm Tax Deductions.

From www.pinterest.com

List of Farm Tax Deductions Tree Farm Tax Deductions one of the potential tax breaks available to tree farm owners is that sales of trees are taxed at capital gains tax rates. this tax guidance helps private forest landowners and rural communities to manage their lands sustainably. If the farmer is not holding. deductible timber expenses are reported on form 1040, schedule f, if operated as. Tree Farm Tax Deductions.

From biznessprofessionals.com

What is a Tax Deduction? Definition, Examples, Calculation Tree Farm Tax Deductions generally, all income received is taxable unless the tax law excludes, and nothing is deductible unless a provision allows it. deductible timber expenses are reported on form 1040, schedule f, if operated as a sole proprietorship. this tax guidance helps private forest landowners and rural communities to manage their lands sustainably. one of the potential tax. Tree Farm Tax Deductions.

From materialmcgheeflusher.z21.web.core.windows.net

And Expense Worksheet Excel Tree Farm Tax Deductions deductible timber expenses are reported on form 1040, schedule f, if operated as a sole proprietorship. for 2018 through 2025, timber investors are not allowed to deduct eligible operating expenses through itemized deductions but. this tax guidance helps private forest landowners and rural communities to manage their lands sustainably. generally, all income received is taxable unless. Tree Farm Tax Deductions.

From printableevacuato6v.z4.web.core.windows.net

Tax Forms And Worksheets Tree Farm Tax Deductions If the farmer is not holding. deductible timber expenses are reported on form 1040, schedule f, if operated as a sole proprietorship. generally, all income received is taxable unless the tax law excludes, and nothing is deductible unless a provision allows it. for 2018 through 2025, timber investors are not allowed to deduct eligible operating expenses through. Tree Farm Tax Deductions.

From www.pinterest.com

Ten Things to Know about Farm and Deductions Things to know Tree Farm Tax Deductions for 2018 through 2025, timber investors are not allowed to deduct eligible operating expenses through itemized deductions but. one of the potential tax breaks available to tree farm owners is that sales of trees are taxed at capital gains tax rates. this tax guidance helps private forest landowners and rural communities to manage their lands sustainably. If. Tree Farm Tax Deductions.

From evon17vvdmaterialdb.z13.web.core.windows.net

Small Business Tax Deduction Worksheets Tree Farm Tax Deductions If the farmer is not holding. generally, all income received is taxable unless the tax law excludes, and nothing is deductible unless a provision allows it. deductible timber expenses are reported on form 1040, schedule f, if operated as a sole proprietorship. one of the potential tax breaks available to tree farm owners is that sales of. Tree Farm Tax Deductions.

From taxdeduction.netlify.app

Tax deductions for farm Tree Farm Tax Deductions If the farmer is not holding. this tax guidance helps private forest landowners and rural communities to manage their lands sustainably. one of the potential tax breaks available to tree farm owners is that sales of trees are taxed at capital gains tax rates. for 2018 through 2025, timber investors are not allowed to deduct eligible operating. Tree Farm Tax Deductions.

From in.pinterest.com

Small Business Tax Spreadsheet Business worksheet, Business tax Tree Farm Tax Deductions deductible timber expenses are reported on form 1040, schedule f, if operated as a sole proprietorship. one of the potential tax breaks available to tree farm owners is that sales of trees are taxed at capital gains tax rates. for 2018 through 2025, timber investors are not allowed to deduct eligible operating expenses through itemized deductions but.. Tree Farm Tax Deductions.

From www.pinterest.com

Farmers can offset certain costs against their to minimize tax Tree Farm Tax Deductions one of the potential tax breaks available to tree farm owners is that sales of trees are taxed at capital gains tax rates. for 2018 through 2025, timber investors are not allowed to deduct eligible operating expenses through itemized deductions but. generally, all income received is taxable unless the tax law excludes, and nothing is deductible unless. Tree Farm Tax Deductions.

From farmhose.blogspot.com

Tree Farm Tax Deductions Farm House Tree Farm Tax Deductions this tax guidance helps private forest landowners and rural communities to manage their lands sustainably. for 2018 through 2025, timber investors are not allowed to deduct eligible operating expenses through itemized deductions but. generally, all income received is taxable unless the tax law excludes, and nothing is deductible unless a provision allows it. If the farmer is. Tree Farm Tax Deductions.

From www.dochub.com

Itemized deductions list Fill out & sign online DocHub Tree Farm Tax Deductions this tax guidance helps private forest landowners and rural communities to manage their lands sustainably. generally, all income received is taxable unless the tax law excludes, and nothing is deductible unless a provision allows it. If the farmer is not holding. for 2018 through 2025, timber investors are not allowed to deduct eligible operating expenses through itemized. Tree Farm Tax Deductions.

From learningmanifoldadh.z14.web.core.windows.net

Tax And Interest Deduction Worksheet 2022 Tree Farm Tax Deductions deductible timber expenses are reported on form 1040, schedule f, if operated as a sole proprietorship. for 2018 through 2025, timber investors are not allowed to deduct eligible operating expenses through itemized deductions but. If the farmer is not holding. generally, all income received is taxable unless the tax law excludes, and nothing is deductible unless a. Tree Farm Tax Deductions.

From old.sermitsiaq.ag

Printable Tax Deduction Cheat Sheet Tree Farm Tax Deductions generally, all income received is taxable unless the tax law excludes, and nothing is deductible unless a provision allows it. one of the potential tax breaks available to tree farm owners is that sales of trees are taxed at capital gains tax rates. for 2018 through 2025, timber investors are not allowed to deduct eligible operating expenses. Tree Farm Tax Deductions.

From taxdeduction.netlify.app

Tax deductions for farm Tree Farm Tax Deductions this tax guidance helps private forest landowners and rural communities to manage their lands sustainably. generally, all income received is taxable unless the tax law excludes, and nothing is deductible unless a provision allows it. for 2018 through 2025, timber investors are not allowed to deduct eligible operating expenses through itemized deductions but. deductible timber expenses. Tree Farm Tax Deductions.